Medicare Payment Rates Are Just the Beginning: Insight to Private Payer Reimbursement Rates

Nicole Coustier has over 20 years of experience in U.S. Reimbursement and Market Access and has helped early-stage MedTech achieve widespread reimbursement coverage in the U.S.

If you’ve ever tried to figure out how much hospitals or physicians are actually reimbursed for a procedure, you’ve likely found yourself navigating a maze with no map.

Medicare reimbursement? That part’s relatively straightforward. The federal government publishes base payment rates in the open, offering a standardized framework that stakeholders—from providers to investors to policy analysts—can model and reference. Yes, those base payments may look startlingly low, but that’s by design: Medicare intends to cover just hospitals’ costs for caring for Medicare beneficiaries, not generate margin for the hospital. Adjustments for things like geography, teaching status, and hospital type can shift the final number significantly from those base payment rates, but the transparency of the Medicare methodology makes apples-to-apples comparisons possible across services and patient populations.

When it comes to private payer reimbursement, however, the trail goes cold. There’s no central repository, no unified methodology, and no clean spreadsheet to download.

And that lack of transparency has real consequences for innovators. Private payer rates are negotiated privately between hospitals and insurance plans, and those negotiations are shaped far more by market leverage than by cost accounting. A dominant hospital system in a concentrated region can demand 2x or 3x the Medicare rate for the same inpatient stay, for example. A smaller community hospital might have to settle for much less.

So when a MedTech founder asks, “What do hospitals get paid for this procedure?” the honest answer is: it depends.

Even when commercial claims data can be accessed through clearinghouses or third-party aggregators, the acquisition cost is steep. We're talking five or six figures just to peek behind the curtain. And even then, coverage policies and payment behavior can be frustratingly opaque. One plan pays at 250% of Medicare; another at a flat per diem. Some follow Medicare’s edits and bundling rules. Others don’t.

Real Indicators of Private Payer Reimbursement

Most early-stage MedTech companies fall back on what’s available: Medicare base payment data. It’s reliable, it’s accessible, and it helps frame a reimbursement floor. But it doesn’t reflect what’s happening across much of the commercial market—especially for physician services, where adoption often depends on reimbursement incentives at the individual provider level.

Thanks to recent analyses, though, we do have some revealing glimpses into the private payer reimbursement:

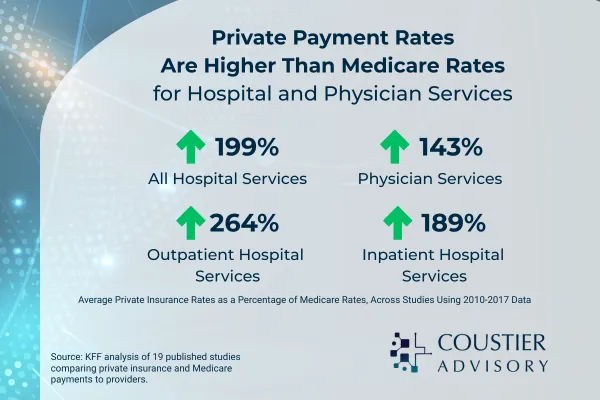

· The Congressional Budget Office (CBO) found that private insurers reimburse hospitals about 2x as much as Medicare for inpatient and outpatient services, and physicians around 142% of Medicare rates, on average.

· The Health Care Cost Institute (HCCI)—drawing from over 1 billion commercial claims—reported that professional service reimbursement from commercial payers averaged 143% of Medicare rates, with some specialties showing even more significant divergence.

· Kaiser Family Foundation (KFF) highlights that inpatient hospital services like C-sections, sepsis care, and joint replacements frequently draw private payer reimbursement that is 1.6x to 3x higher than Medicare—with little correlation to quality or complexity. These patterns are consistent, nationwide, and still largely invisible to anyone without access to proprietary claims data (which can cost six figures just to license).

· Or, check out the beautiful chart below, also from KFF:

These are back-of-the-envelope figures, but if you’re not ready to drop five or six figures on claims data, these will serve better for your financial modeling than Medicare base payment rates alone.

What MedTech Can Do

If you’re designing a financial model based solely on Medicare rates, you may be underestimating your value in some markets—or misjudging the barriers to adoption in others. A hospital with a favorable commercial payer mix may see a far stronger business case for adopting new technology. Conversely, a safety-net hospital serving mostly Medicare and Medicaid patients might struggle, even if the clinical value is clear.

It’s not enough to know that there’s a code, or that Medicare pays something. You need to understand how real-world reimbursement behavior influences hospital decision-making—and how payer mix, contracting structures, and physician alignment affect the trajectory of your product.

Even though commercial rates are mysterious, they’re not irrelevant. In fact, for many hospitals, commercial payers represent the margin. Medicare may keep the lights on. Private insurers pay for innovation, growth, and yes—new technology.

That’s why reimbursement strategy can’t be about codes alone. It must factor in payer mix, site-of-service economics, and how hospitals think about ROI in the real world.

Until there’s full price transparency across the board (don’t hold your breath), understanding this dual-reality of public benchmarks and private mysteries is what separates the surface-level strategists from the market-ready ones.

Do you have U.S. commercialization questions? Schedule an Introductory Call

Whether it's how the multiple payer landscape works in the U.S., how to validate device or procedure coding, timelines associate with product uptake - we're happy to answer them.